Roaring 2020s?

Our last quarterly newsletter celebrated the “pessimism-defying rally” of November and December 2023.

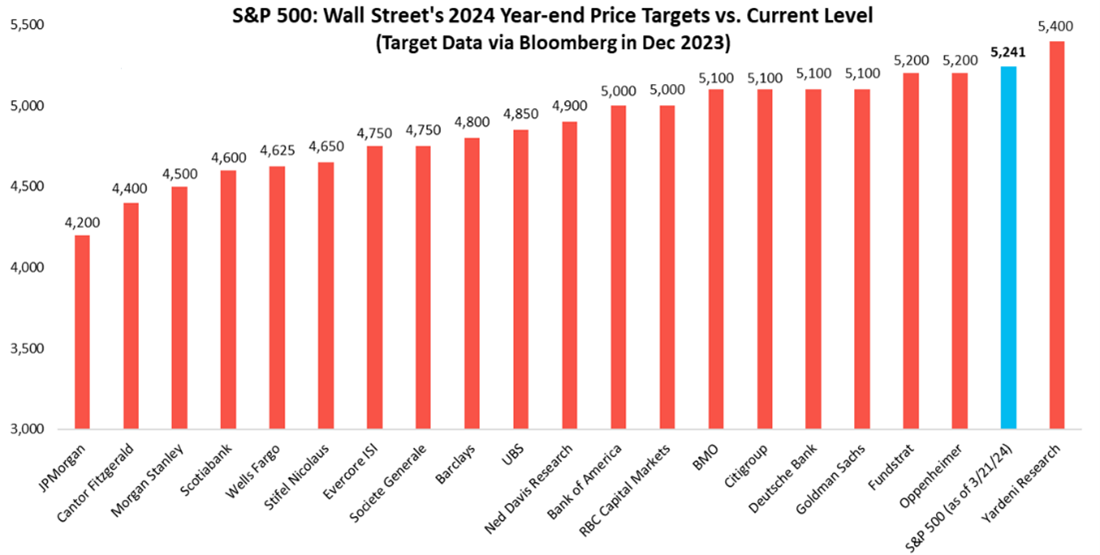

The surge has extended into 2024. The S&P 500 index has already exceeded most Wall Street forecasts for 2024 (it began the year at 4770).

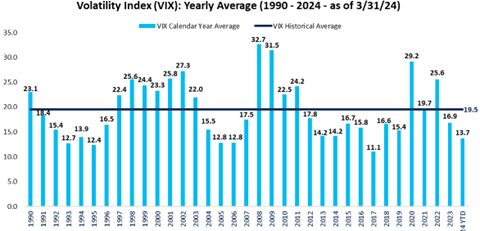

The index’s 10% gain is the first back-to-back double-digit quarterly gain since 2012. The largest intra-quarter drawdown was a mere 1.7%. Per the VIX, a measure of volatility, the 2024 market is calmer so far than any year since 2017.

Unemployment has been sub-4% for two years, the longest streak since the 1960s. New business applications have exploded. Inflation is down. GDP growth is up. Economists debate Artificial Intelligence’s coming impact on productivity – merely transformative or a new Industrial Revolution.

Consumers are acting like it’s the 21st Century Roaring 20s. Retails sales, restaurant spending, and air travel are all well above their pre-pandemic pace.

You can even earn 5% on cash!

Sure, there are also reasons for negativity and concern. Yet, few seem to appreciate how well the market and economy are doing.

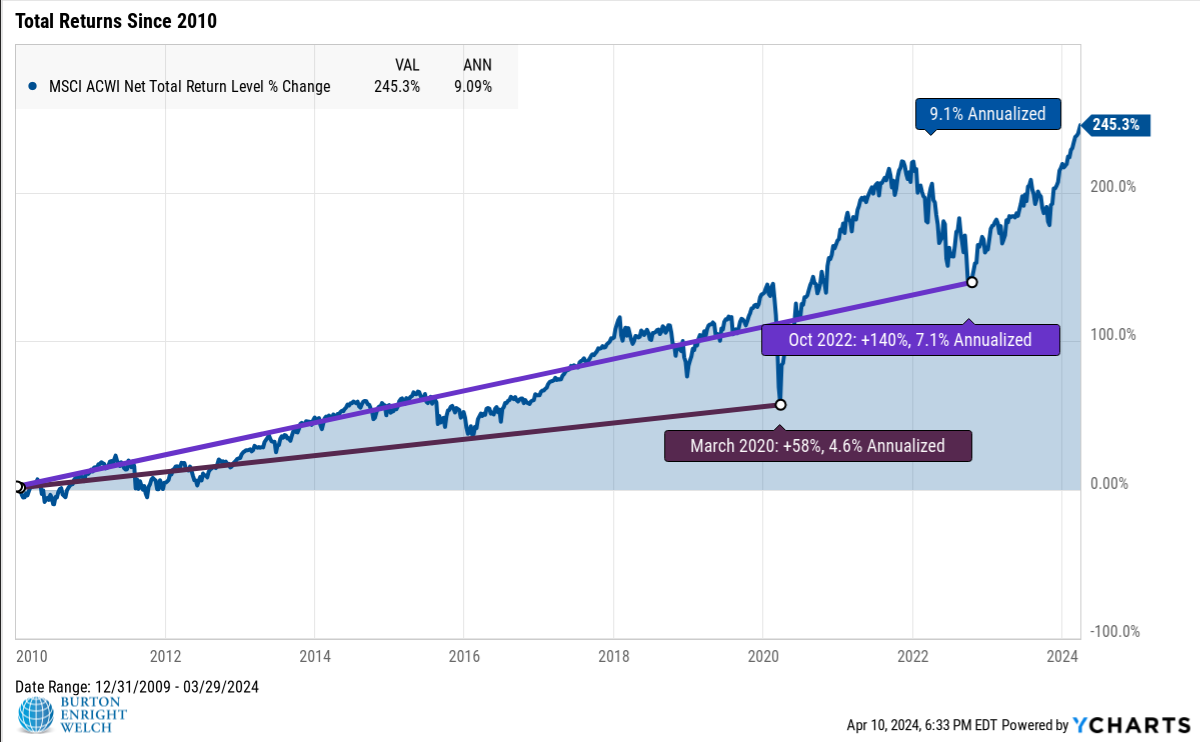

In the throes of March 2020 and October 2022, no one foresaw an imminent bull market. Many obsessed over how much deeper stocks would plunge.

The next chart shows the substantial returns investors in a globally diversified portfolio would have sacrificed had they sold amidst the downturns. Per the recently departed Charlie Munger, “the first rule of compounding is to never interrupt it unnecessarily.”

Perhaps the Roaring 20s are instructive. The 1910s featured World War I, a global pandemic, and major recessions. Few then predicted that the 1920s would be one of the country’s most groundbreaking and prosperous periods.

While recent challenges haven’t been as nightmarish, they’ve understandably soured moods. The Roaring 20s shows how people can shrug off gloom and launch an era of innovation, wealth creation, and exuberance.

Hopefully, we’re witnessing the early whispers of the Roaring 2020s. In any event, the last two quarters are a well-deserved reward for resilience and a reminder of how quickly bust can turn to boom.